Dear Partner,

In the third quarter of 2022, Woodbridge Capital Partners I, LP (the “Partnership”) returned -9.52% while the S&P 500 returned -4.88% (with dividends reinvested). Since its inception in April 2020, the Partnership has returned 97.0% compared to the S&P 500’s 40.0%.1

The beginning of this year marked a sharp shift in market sentiment from COVID-stimulus induced euphoria to the inevitable hangover. Last quarter, the market entered a bear market as concerns about inflation and corresponding rate hikes were at the forefront of investor psychology. This picture hasn’t changed much as inflation figures for August continued to hover between 8% and 9%.2 The Fed appears poised to proceed with rate hikes through this year and into the next, and, as expected, the US has entered a recession (defined as two consecutive quarters of declining GDP). In short, the economy is fraught with uncertainty and macroeconomic fears.

The bear market in and of itself is not cause for alarm. As discussed in depth in our previous letter, the main driver of poor market returns in the high-inflation, rising-rates environment of the 1970s was multiple contraction. Such has been the case for the S&P 500 so far this year. Year-to-date, the S&P is down around 23% while the PE is estimated to have declined from 23.11 to 18.39, or around 20%, over the same period.3 Although these figures aren’t exact, the conclusion is clear: the market decline is primarily a reflection of market sentiment, not of intrinsic value.

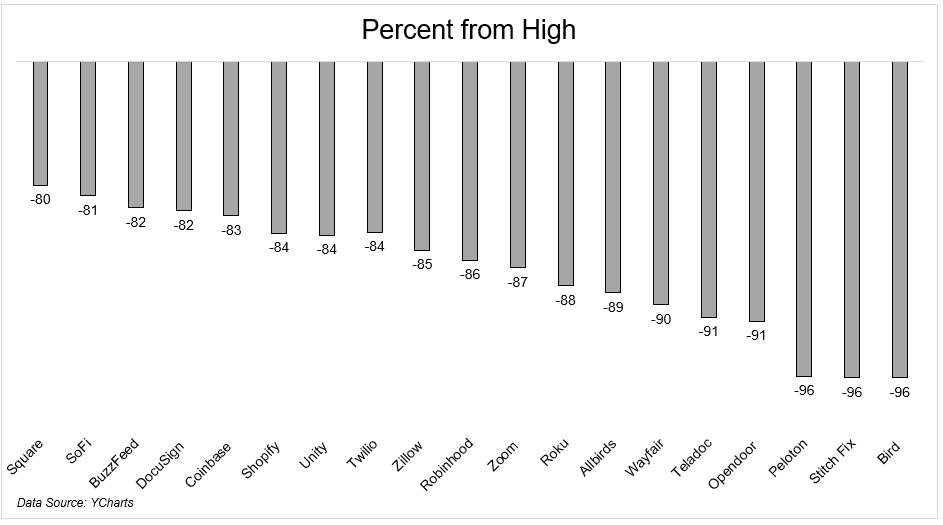

This shift in sentiment is especially evident in yesteryear’s high-flying growth stocks whose valuations in the form of exorbitant PE multiples were fueled by overly optimistic growth projections rather than a sober analysis of intrinsic value. As you might imagine, those stocks whose prices soared in tandem with optimism have plummeted as euphoria gave way to sobriety. The chart below lists the stocks down a whopping 80% or more since their recent highs.4

Unsurprisingly, all of these stocks had valuations that were predicated on unrealistic growth projections. For investors who purchased such stocks at excessive multiples, multiple contraction represents a convergence to intrinsic value and, therefore, a likely permanent loss.

The fate of these stocks serves as a sobering reminder that intrinsic value in the form of cold hard cash is the only safeguard from permanent loss. While prices may fluctuate erratically with the temperamental moods of the market, those gains and losses are ultimately ephemeral. As value investing pioneer Benjamin Graham famously put it, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

On the flip side, excessive fear and risk aversion can drive the prices of some stocks well below their intrinsic value, offering the opportunity for exceptional returns to those willing to stomach discomfort in the short term. Needless to say, Jesse and I believe that our portfolio falls within this latter category. We believe the current downturn has further widened the gap between price and intrinsic value and are positioned accordingly.

Of course, unlike multiple contractions, rising rates and the resulting recession represent a real cost to intrinsic value. Even then, Jesse and I are largely agnostic for a few reasons. Firstly, we believe that the aforementioned widening gap between the price and value of our portfolio will more than compensate for the economic headwinds. Secondly, we diversify our portfolio to remain relatively neutral across a wide variety of macro environments. And finally, we believe making investment decisions on the basis of uncertain macro forecasts has more potential for harm than good. In the words of Mark Twain, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

We remain confident that the Partnership will outperform the S&P 500 over the long term. In fact, the investment opportunities currently available are the best we’ve seen since the 2020 stock market crash. We thank you for your patience and your trust. If you ever have questions or concerns about your investment, please do not hesitate to reach out to us. As always, we remain committed to your investment success.

Thank you,

Kyosuke Mitsuishi & Jesse Flowers

1https://finance.yahoo.com/quote/%5ESP500TR/history?p=%5ESP500TR 2https://www.bls.gov/news.release/cpi.nr0.htm 3https://www.multpl.com/s-p-500-pe-ratio/table/by-month 4https://theirrelevantinvestor.com/2022/09/30/the-down-80-percent-club/